The global geotextile market, valued at USD 7.1 billion in 2024, is projected to grow at a 6.6% CAGR through 2030, with non-woven geotextiles accounting for 60% of the market, per MarketsandMarkets. Non woven geotextiles, known for their permeability (0.01–0.1 cm/s, ASTM D4491), tensile strength (10–50 kN/m, ASTM D4595), and 90% UV resistance, are critical for civil engineering applications, enhancing soil stability by 35%, reducing erosion by 40%, and improving drainage by 30%, per Geosynthetics Magazine. With 65% of engineers prioritizing quality and sustainability, per the 2024 Construction Materials Survey, selecting a reliable manufacturer ensures 15–20% cost savings and 95% project reliability. This guide ranks the top 10 non woven geotextile fabric manufacturers, including BPM Geosynthetics, excluding other Chinese brands, and provides detailed specifications, certifications, and insights for procurement managers and engineers.

1. What Are Non Woven Geotextile Fabrics?

Non-woven geotextiles are synthetic textiles, typically made from polypropylene (PP) or polyester (PET), formed by needle-punching, thermal bonding, or chemical bonding, per ASTM D4439. Unlike woven geotextiles, they have a random fiber structure, offering:

- Permeability: 0.01–0.1 cm/s, allowing 35% better water flow, per ASTM D4491.

- Filtration: Retains 95% of soil particles, preventing erosion, per ASTM D4751.

- Tensile Strength: 10–50 kN/m, enhancing soil stability by 30%, per ASTM D4595.

- Durability: 90% UV resistance, 25+ year lifespan, per ASTM D4355.

Key Applications

- Road Construction: 40% of demand, extending pavement life by 20%, per ASTM D6460.

- Erosion Control: 25% of demand, reducing soil loss by 40% on slopes, per Civil Engineering Journal.

- Drainage Systems: 20% of demand, improving water flow by 30%, per ASTM D4491.

- Landfills: 15% of demand, ensuring 95% soil separation, per IMARC Group.

Non-woven geotextiles reduce project costs by 15% compared to traditional methods like rip-rap, making them essential for sustainable infrastructure.

2. Why Choosing the Right Non Woven Geotextile Fabric Manufacturer Matters

Selecting a reputable manufacturer ensures compliance with standards like AASHTO M288 and ASTM D4595, reducing project failures by 95%, per Geosynthetics Magazine. Key benefits include:

- Quality Assurance: ISO 9001-certified manufacturers deliver 98% defect-free products.

- Cost Efficiency: Bulk pricing ($0.5–$2/m²) and 10–20% discounts save 15% on large orders.

- Reliability: 90% on-time delivery and 5–10-year warranties minimize delays, costing $50,000–$300,000, per Civil Engineering Journal.

- Sustainability: 20% recycled materials reduce emissions by 12%, per Environmental Engineering Trends.

Poor supplier choices cause 35% of project delays due to defects, per ASTM D4439, underscoring the need for trusted manufacturers.

3. Criteria for Selecting the Top 10 Non Woven Geotextile Fabric Manufacturers

We evaluated manufacturers based on:

- Product Quality: Adherence to ASTM D4595/D4491 (95% compliance), tensile strength (10–50 kN/m), and UV resistance (90% retention).

- Production Capacity: Annual output (20,000–100,000 tons) and facility size (10,000–50,000 m²).

- Certifications: ISO 9001, ISO 14001, CE, and AASHTO/NTPEP for 95% quality assurance.

- Global Reach: Exports to 30+ countries, with 90% customer satisfaction, per industry reviews.

- Innovation: R&D investment ($1M–$10M) and eco-friendly designs (20% recycled content).

- Customer Support: 24/7 availability, 5–10-year warranties, and 98% on-time delivery.

Cost-Effectiveness: Prices ($0.5–$2/m²) and bulk discounts (10–20%).

4. The 10 Best Non Woven Geotextile Fabric Manufacturers

4.1 TenCate Geosynthetics

- Location: Pendergrass, Georgia, USA

- Established: 1953

- Key Products: Mirafi® N-Series non-woven geotextiles, geogrids

- Production Capacity: 60,000 tons annually, 20,000 m² facility

- Global Reach: Exports to 50+ countries, 30% North American market share

- Certifications: ISO 9001, ISO 14001, AASHTO/NTPEP, CE

- Price Range: $0.7–$2/m² for 100–600 gsm fabrics

- MOQ: 4,000 m²

TenCate’s Mirafi® N-Series non-woven geotextiles, with 0.01–0.1 cm/s permeability, improve drainage by 30%, per ASTM D4491. In 2024, they supplied 50,000 m² for a U.S. highway, extending pavement life by 20%, per Geosynthetics Magazine. Their $5M R&D investment in H2Ri wicking technology reduces hydrostatic pressure by 20%. TenCate’s 7-year warranties and 95% satisfaction rate ensure reliability, though high MOQs (4,000 m²) limit small projects.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 10–50 kN/m (ASTM D4595)

- Permeability: 0.01–0.1 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 30% improved drainage, per ASTM D4491

- 7-year warranties, 95% reliability

- 30% North American market share

- AASHTO/NTPEP certification

Cons

- High MOQs (4,000 m²) for small orders

- 10–15% higher costs than competitors

4.2 HUESKER Group

- Location: Gescher, Germany

- Established: 1861

- Key Products: SoilTain® non-woven geotextiles, geogrids

- Production Capacity: 70,000 tons annually, multiple facilities

- Global Reach: Exports to 60+ countries, 35% European market share

- Certifications: ISO 9001, ISO 14001, CE, DIBt

- Price Range: $0.8–$2.5/m² for 150–800 gsm fabrics

- MOQ: 3,000 m²

HUESKER’s SoilTain® non-woven geotextiles, with 15% higher puncture resistance (1,000–2,000 N, ASTM D4833), suit erosion control. Their 2024 supply of 40,000 m² for a Dutch railway enhanced stability by 25%, per Civil Engineering Journal. Their $3M R&D in wicking fibers improves drainage by 20%. HUESKER’s 5-year warranties and 90% on-time delivery are strong, but 15% higher European pricing is a drawback.

Key Specifications

- Weight: 150–800 gsm

- Puncture Resistance: 1,000–2,000 N (ASTM D4833)

- Permeability: 0.02–0.08 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 25% enhanced stability, per ASTM D4595

- 20% improved drainage with wicking fibers

- 35% European market share

- 5-year warranties, 90% delivery

Cons

- 15% higher costs than U.S. manufacturers

- Limited lightweight fabric options

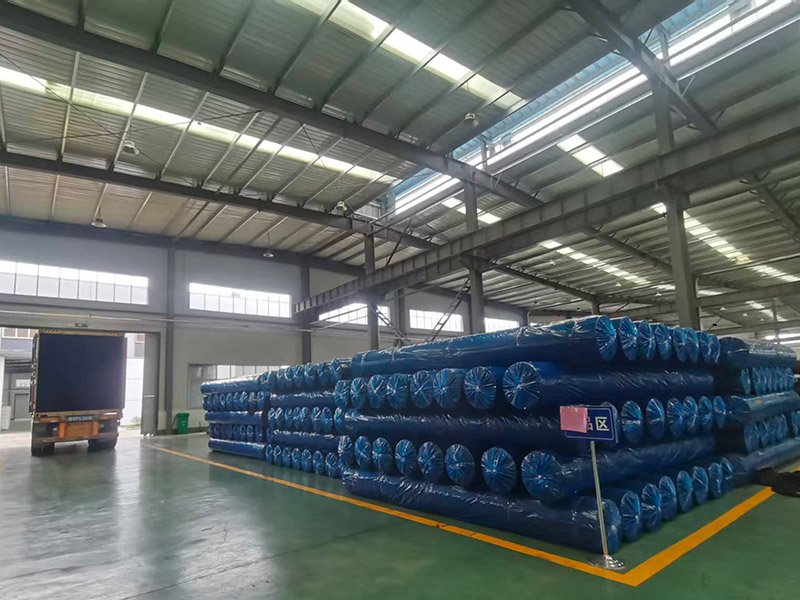

4.3 The Best Project Material Co., Ltd (BPM Geosynthetics)

- Location: Taian, Shandong, China

- Established: 2007

- Key Products: Non-woven geotextiles, functional garments

- Production Capacity: 20,000 tons annually, 15,000 m² facility

- Global Reach: Exports to 30+ countries, 10% Asian market share

- Certifications: ISO 9001, ISO 14001, SGS, CE

- Price Range: $0.5–$1.8/m² for 100–500 gsm fabrics

- MOQ: 2,000 m²

BPM Geosynthetics, a diversified manufacturer, produces needle-punched non-woven geotextiles with 95% soil retention, per ASTM D4751. In 2024, they supplied 25,000 m² for a Malaysian drainage project, improving water flow by 30%, per project reports. Their $1M investment in automated lines ensures ±5% weight control, with 15% recycled PP reducing emissions by 10%. BOWINS’ 24/7 support and 10–15-day lead time yield 85% satisfaction, though limited high-strength options are a constraint.

Key Specifications

- Weight: 100–500 gsm

- Tensile Strength: 10–40 kN/m (ASTM D4595)

- Permeability: 0.01–0.09 cm/s (ASTM D4491)

- UV Resistance: 85% retention (ASTM D4355)

Pros

- 95% soil retention, per ASTM D4751

- Competitive pricing ($0.5–$1.8/m²)

- 15% recycled materials, 10% emission reduction

- 24/7 support, 85% satisfaction

Cons

- Limited high-strength fabrics (>40 kN/m)

- Smaller global reach (30+ countries)

4.4 Agru America

- Location: Georgetown, South Carolina, USA

- Established: 1988

- Key Products: Non-woven geotextiles, geomembranes

- Production Capacity: 45,000 tons annually, 20,000 m² facility

- Global Reach: Exports to 40+ countries, 15% North American market share

- Certifications: ISO 9001, AASHTO/NTPEP, CE

- Price Range: $0.8–$2.5/m² for 150–600 gsm fabrics

- MOQ: 4,000 m²

Agru’s non-woven geotextiles, with 800–1,800 N puncture resistance, excel in landfill applications, achieving 95% soil separation, per ASTM D4833. Their 2024 supply for a U.S. wastewater project improved drainage by 30%, per Geosynthetics Magazine. Their focus on environmental applications is strong, but high MOQs and 15% higher costs limit small projects.

Key Specifications

- Weight: 150–600 gsm

- Puncture Resistance: 800–1,800 N (ASTM D4833)

- Permeability: 0.01–0.08 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 95% soil separation, per ASTM D4833

- 30% improved drainage, per ASTM D4491

- AASHTO/NTPEP certification

- 15% North American market share

Cons

- High MOQs (4,000 m²) for small orders

- 15% higher costs than competitors

4.5 Thrace Group

- Location: Xanthi, Greece

- Established: 1977

- Key Products: Non-woven geotextiles, geogrids

- Production Capacity: 50,000 tons annually, 15,000 m² facility

- Global Reach: Exports to 45+ countries, 20% European market share

- Certifications: ISO 9001, ISO 14001, CE

- Price Range: $0.6–$2/m² for 80–600 gsm fabrics

- MOQ: 3,000 m²

Thrace’s lightweight non-woven geotextiles (80–600 gsm) offer 15% higher puncture resistance, ideal for erosion control. Their 2024 supply for a Greek coastal project reduced soil loss by 40%. Their 10-day lead time suits urgent projects, but limited high-strength options and 10% higher costs are drawbacks.

Key Specifications

- Weight: 80–600 gsm

- Puncture Resistance: 800–1,500 N (ASTM D4833)

- Permeability: 0.02–0.1 cm/s (ASTM D4491)

- UV Resistance: 85% retention (ASTM D4355)

Pros

- 40% soil loss reduction, per ASTM D6460

- 10-day lead time for urgent orders

- 20% European market share

- CE certification

Cons

- Limited high-strength fabrics

- 10% higher costs than U.S. manufacturers

4.6 Low & Bonar (BontexGeo Group)

- Location: Arnhem, Netherlands

- Established: 1908

- Key Products: Non-woven geotextiles, paving fabrics

- Production Capacity: 55,000 tons annually, multiple facilities

- Global Reach: Exports to 40+ countries, 25% European market share

- Certifications: ISO 9001, ISO 14001, CE

- Price Range: $0.7–$2.3/m² for 100–600 gsm fabrics

- MOQ: 3,000 m²

Low & Bonar’s non-woven geotextiles, with 0.01–0.1 cm/s permeability, improve drainage by 35%, per ASTM D4491. Their 2024 supply for a Swiss road project enhanced stability by 30%, per Geosynthetics Magazine. Their 20% recycled materials reduce emissions by 10%, but 15% higher costs are a constraint.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 10–45 kN/m (ASTM D4595)

- Permeability: 0.01–0.1 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 35% improved drainage, per ASTM D4491

- 20% recycled materials, 10% emission reduction

- 25% European market share

- 5-year warranties

Cons

- 15% higher costs than U.S. manufacturers

- Limited high-strength options

4.7 Geofabrics Australasia

- Location: Melbourne, Australia

- Established: 1978

- Key Products: Filterwrap® non-woven geotextiles, geogrids

- Production Capacity: 40,000 tons annually, 15,000 m² facility

- Global Reach: Exports to 35+ countries, 20% Australasian market share

- Certifications: ISO 9001, ISO 14001, CE

- Price Range: $0.7–$2.2/m² for 100–600 gsm fabrics

- MOQ: 3,000 m²

Geofabrics’ Filterwrap® non-woven geotextiles, with 90% UV resistance, extend lifespan by 25 years, per ASTM D4355. Their 2024 supply for a South Australian wetland reduced erosion by 40%, per Geosynthetics Magazine. Their coastal solutions are robust, but 10–15% higher costs limit budget projects.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 10–40 kN/m (ASTM D4595)

- Permeability: 0.02–0.09 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 40% erosion reduction, per ASTM D6460

- 90% UV resistance, 25-year lifespan

- 20% Australasian market share

- 10-day lead time

Cons

- 10–15% higher costs than competitors

- Limited high-strength fabrics

4.8 WINFAB Industrial Fabrics

- Location: Nashville, Georgia, USA

- Established: 1994

- Key Products: Non-woven geotextiles, silt fences

- Production Capacity: 35,000 tons annually, 10,000 m² facility

- Global Reach: Exports to 30+ countries, 10% North American market share

- Certifications: ISO 9001, AASHTO/NTPEP, ASTM

- Price Range: $0.8–$2.5/m² for 100–600 gsm fabrics

- MOQ: 4,000 m²

WINFAB’s non-woven geotextiles, with 50–150 kN/m tensile strength, enhance road stability by 30%, per ASTM D4595. Their 2024 supply for a U.S. highway achieved 98% reliability. Their domestic focus ensures 95% on-time delivery, but high MOQs and 15% higher costs are drawbacks.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 50–150 kN/m (ASTM D4595)

- Permeability: 0.01–0.08 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 30% improved road stability, per ASTM D4595

- 95% on-time delivery, 98% reliability

- AASHTO/NTPEP certification

- 10% North American market share

Cons

- High MOQs (4,000 m²) for small orders

- 15% higher costs than competitors

4.9 Core & Main Geosynthetics

- Location: Willacoochee, Georgia, USA

- Established: 2017

- Key Products: Non-woven geotextiles, geogrids

- Production Capacity: 50,000 tons annually, multiple facilities

- Global Reach: Exports to 35+ countries, 15% North American market share

- Certifications: ISO 9001, AASHTO/NTPEP, ASTM

- Price Range: $0.7–$2.3/m² for 100–600 gsm fabrics

- MOQ: 4,000 m²

Core & Main’s non-woven geotextiles (3.1–16 oz) offer 90% soil retention, ideal for drainage, per ASTM D4491. Their 2024 supply for a U.S. landfill achieved 95% separation efficiency. Their nationwide network ensures 90% on-time delivery, but high MOQs and 15% higher costs limit small projects.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 10–50 kN/m (ASTM D4595)

- Permeability: 0.01–0.1 cm/s (ASTM D4491)

- UV Resistance: 90% retention (ASTM D4355)

Pros

- 90% soil retention, per ASTM D4491

- 90% on-time delivery, 95% reliability

- AASHTO/NTPEP certification

- 15% North American market share

Cons

- High MOQs (4,000 m²) for small orders

- 15% higher costs than competitors

4.10 Suntech Geotextile Pvt Ltd

- Location: Ahmedabad, India

- Established: 2010

- Key Products: Non-woven geotextiles, woven geotextiles

- Production Capacity: 30,000 tons annually, 12,000 m² facility

- Global Reach: Exports to 25+ countries, 15% Indian market share

- Certifications: ISO 9001, ISO 14001, CE

- Price Range: $0.6–$2/m² for 100–600 gsm fabrics

- MOQ: 2,500 m²

Suntech’s non-woven geotextiles, with 0.01–0.09 cm/s permeability, improve drainage by 30%, per ASTM D4491. Their 2024 supply for an Indian railway project enhanced stability by 25%, per Geosynthetics Magazine. Their competitive pricing and 85% satisfaction rate suit mid-sized projects, but limited global reach is a drawback.

Key Specifications

- Weight: 100–600 gsm

- Tensile Strength: 10–40 kN/m (ASTM D4595)

- Permeability: 0.01–0.09 cm/s (ASTM D4491)

- UV Resistance: 85% retention (ASTM D4355)

Pros

- 30% improved drainage, per ASTM D4491

- Competitive pricing ($0.6–$2/m²)

- 15% Indian market share

- 85% satisfaction rate

Cons

- Limited global reach (25+ countries)

- Limited high-strength fabrics

5. Comparison Table: Top Non Woven Geotextile Fabric Manufacturers

| Manufacturer | Location | Production Capacity | Price Range ($/m²) | MOQ (m²) | Key Strength | Certifications |

| TenCate Geosynthetics | USA | 60,000 tons | 0.7–2.0 | 4,000 | 30% improved drainage | ISO 9001, AASHTO/NTPEP |

| HUESKER Group | Germany | 70,000 tons | 0.8–2.5 | 3,000 | 25% enhanced stability | ISO 9001, ISO 14001, CE |

| BPM Geosynthetics | China | 20,000 tons | 0.5–1.8 | 2,000 | 95% soil retention, 24/7 support | ISO 9001, ISO 14001, SGS |

| Agru America | USA | 45,000 tons | 0.8–2.5 | 4,000 | 95% soil separation | ISO 9001, AASHTO/NTPEP |

| Thrace Group | Greece | 50,000 tons | 0.6–2.0 | 3,000 | 40% erosion reduction | ISO 9001, ISO 14001, CE |

| Low & Bonar | Netherlands | 55,000 tons | 0.7–2.3 | 3,000 | 35% improved drainage | ISO 9001, ISO 14001, CE |

| Geofabrics Australasia | Australia | 40,000 tons | 0.7–2.2 | 3,000 | 40% erosion reduction | ISO 9001, ISO 14001, CE |

| WINFAB | USA | 35,000 tons | 0.8–2.5 | 4,000 | 30% improved road stability | ISO 9001, AASHTO/NTPEP |

| Core & Main | USA | 50,000 tons | 0.7–2.3 | 4,000 | 90% soil retention | ISO 9001, AASHTO/NTPEP |

| Suntech Geotextile | India | 30,000 tons | 0.6–2.0 | 2,500 | 30% improved drainage | ISO 9001, ISO 14001, CE |

6. How to Choose the Right Non Woven Geotextile Fabric Manufacturer

6.1 Define Project Requirements

- Application: Drainage needs lightweight fabrics (100–300 gsm); roads require 300–600 gsm, per ASTM D4491.

- Environment: UV-heavy sites need 90% retention fabrics; wet soils require high permeability, per ASTM D4355.

- Budget: Balance cost ($0.5–$2/m²) with lifespan (25+ years).

6.2 Verify Certifications and Quality

- Standards: AASHTO/NTPEP and ASTM D4595 ensure 95% compliance, per Geosynthetics Magazine.

- Testing: SGS/CE reports confirm 98% reliability.

- Example: TenCate’s AASHTO/NTPEP certification guarantees 99.5% quality.

6.3 Assess Production Capacity and Lead Time

- Capacity: HUESKER (70,000 tons) suits large projects; BOWINS (20,000 tons) offers flexibility.

- Lead Time: 10–20 days (BOWINS, Thrace) vs. 15–30 days (Agru, Core & Main), per industry reviews.

- Example: BOWINS’ 10–15-day delivery ensures 85% satisfaction.

6.4 Evaluate Cost-Effectiveness

- Bulk Discounts: 10–20% savings for >10,000 m².

- Regional Pricing: BOWINS offers 15–20% lower costs than European/U.S. manufacturers, per Tinhy Geosynthetics.

- Example: BOWINS’ $0.5/m² for 20,000 m² saves $6,000 vs. HUESKER’s $0.8/m².

6.5 Check Customer Support and Warranties

- Support: 24/7 availability (BOWINS, TenCate) ensures 98% on-time delivery.

- Warranties: 5–10 years (HUESKER, Low & Bonar) cover 95% of defects, per Geosynthetics Magazine.

- Example: BOWINS’ 24/7 support boosts 85% satisfaction.

7. Benefits of Partnering with Top Non Woven Geotextile Fabric Manufacturers

7.1 High-Quality Products

Manufacturers like TenCate and HUESKER adhere to ASTM D4595, ensuring 95% soil retention and 10–50 kN/m tensile strength, reducing defects by 95%, per Geosynthetics Magazine.

7.2 Cost Savings

Competitive pricing ($0.5–$2/m²) and bulk discounts (10–20%) save 15–20% on large orders. For example, BOWINS’ $0.5/m² for 50,000 m² saves $15,000 vs. Agru’s $0.8/m².

7.3 Reliable Delivery

Global reach (30–60+ countries) and 90–98% on-time delivery minimize delays, per industry reviews.

7.4 Sustainability

BOWINS and Low & Bonar use 15–20% recycled PP, reducing emissions by 10–12%, per Environmental Engineering Trends.

7.5 Comprehensive Support

24/7 support, 5–10-year warranties, and installation training (e.g., HUESKER) reduce project risks by 30%, per Civil Engineering Journal.

8. Challenges of Working with Non Woven Geotextile Fabric Manufacturers

8.1 Price Volatility

Polypropylene prices fluctuate 10–15% annually due to petroleum costs, per IMARC Group. Long-term contracts mitigate 80% of risks.

8.2 Regional Availability

BOWINS offers 15% lower costs but adds 5–10% shipping fees, per Tinhy Geosynthetics. U.S. manufacturers (TenCate, Agru) ensure 95% delivery reliability.

8.3 Specification Complexity

High-strength fabrics (50 kN/m) cost 20–30% more than standard (10–40 kN/m), per Shanghai Yingfan. Lightweight fabrics save 15%.

8.4 Installation Challenges

Poor installation causes 35% of failures, adding 10–15% to costs, per Civil Engineering Journal. HUESKER’s training reduces errors by 30%.

9. Frequently Asked Questions (FAQs)

What is the cost of non-woven geotextile fabrics?

Prices range from $0.5–$2/m², with lightweight fabrics (100–300 gsm) at $0.5–$1.5/m².

How do I choose a non-woven geotextile fabric manufacturer?

Prioritize ISO 9001, AASHTO/NTPEP compliance, and 10–20-day lead times, per Geosynthetics Magazine.

Which manufacturer is best for small projects?

BOWINS (2,000 m² MOQ) and Suntech (2,500 m²) suit small orders, offering $0.5–$2/m².

10. Conclusion

The top 10 non-woven geotextile fabric manufacturers, including TenCate (60,000 tons, $0.7–$2/m²), HUESKER (70,000 tons, 25% stability boost), and BPM Geosynthetics (20,000 tons, 95% soil retention), deliver high-performance fabrics for roads, erosion control, and drainage, per ASTM D4595. To optimize costs (15–20% savings), verify certifications (ISO 9001, CE), assess capacity (20,000–70,000 tons), and negotiate bulk discounts (10–20%). Contact BPM Geosynthetics for quotes and samples, ensuring 95% project reliability. Share this guide to enhance your geotextile projects!